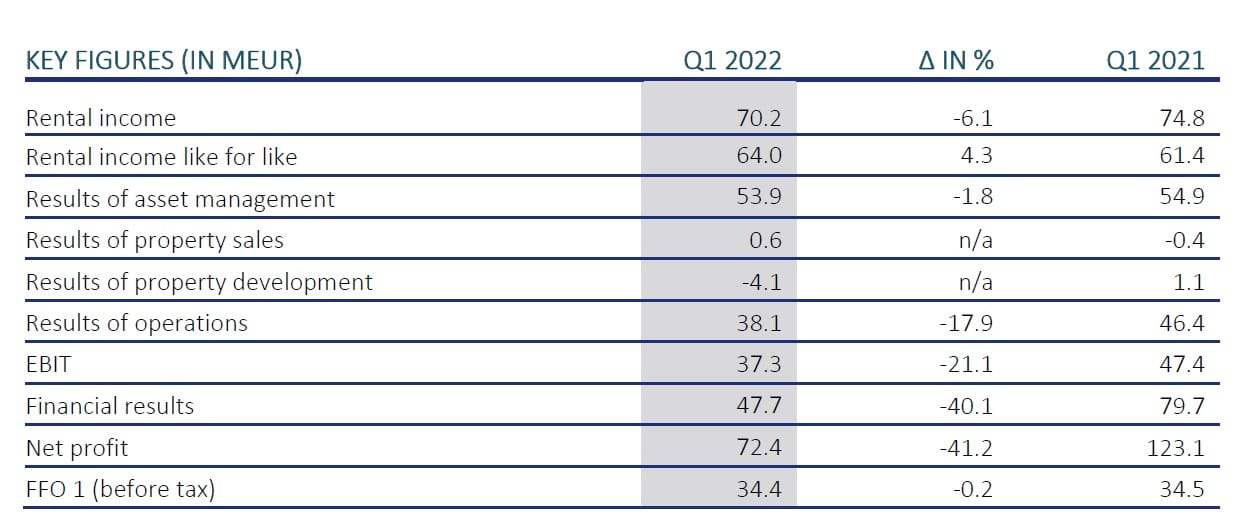

IMMOFINANZ successfully completed a solid start into the 2022 financial year. Like-for-like rental income rose by 4.3% in the first quarter, the occupancy rate remained high at 94.4%, and FFO 1 before tax was stable at a very good level of EUR 34.4 million.

Occupancy Rate at a High Level

The IMMOFINANZ property portfolio covered 225 properties as of 31 March 2022 with a combined value of EUR 5.2 billion. Standing investments represented the largest component at EUR 4.6 billion and 2.0 million sqm of rentable space. At 94.4% (31 December 2021: 95.1%), the occupancy rate remained high. The retail properties

were practically fully rented at 98.4%. The gross return on the standing investment portfolio equaled 5.9% based on IFRS rental income and 6.2% based on invoiced rents.

Radka Doehring, member of the Executive Board of IMMOFINANZ stated:

We further expanded our position as the leading retail park operator in Europe this year with the acquisition of another retail park in Italy. We also recently completed a STOP SHOP in the Croatian city of Kastela and opened with full occupancy. Our plans call for the continuation of our growth course in the promising Adriatic region, and we will soon start construction on further retail park projects in Croatia.

Rental Income

Rental income totaled EUR 70.2 million in the first quarter. The year-on-year decline (Q1 2021: EUR 74.8 million) is attributable to a positive non-recurring compensation payment of EUR 6.7 million in the first quarter of 2021 from a large tenant for a pandemic-related reduction in a rented space. After an adjustment for this nonrecurring effect, rental income rose by 3.1%. Rental income also exceeded the Q4 2021 level by 2.8%. This positive development was also reflected in an increase of 4.3% in like-for-like rental income (adjusted for acquisitions, sales, and completions) over Q1 2021.

Dietmar Reindl, member of the Executive Board of IMMOFINANZ explained:

The strong growth in like-for-like rental income underscores the optimal positioning of our portfolio. This mix of affordable retail for consumers and high-quality, innovative and flexible office solutions meets the requirements of our tenants as well as their customers and employees. The positive development was recorded in most of the markets – led by Austria. Like-for-like rental income rose by 2.9% in the office business and by 5.6% in the retail business, which impressively demonstrates the strength of our STOP SHOP and myhive brands.

Results of Asset Management

Property expenses fell by 28.5% to EUR -12.2 million, above all due to a sharp drop to EUR -0.4 million (Q1 2021:EUR -6.2 million) in the write-off of rent receivables included in this position. These write-offs represented support by IMMOFINANZ for its tenants during the pandemic-related lockdown periods in 2020 and 2021. The write-offs of rent receivables declined to the pre-crisis level in Q1 2022. The results of asset management were stable year on-year at EUR 53.9 million (Q1 2021: EUR 54.9 million).

Results of Property Sales

The results of property sales rose to EUR 0.6 million (Q1 2021: EUR -0.4 million) based on sales of EUR 2.5 million. The sold properties consisted mainly of non-core land in Turkey.

Results of Property Development

The results of property development amounted to EUR -4.1 million (Q1 2021: EUR 1.1 million) and resulted chiefly from a general increase in the construction costs for individual projects.

Results of Operations

Other operating expenses rose to EUR -12.9 million (Q1 2021: EUR -10.1 million), mainly due to consulting costs in connection with the takeover offers by the CPI Property Group and S IMMO for IMMOFINANZ and in connection with digitalization measures. Consequently, the results of operations equaled EUR 38.1 million (Q1 2021:

EUR 46.4 million).

EBIT

Results from the revaluation of standing investments amounted to EUR -0.7 million (Q1 2021: EUR 1.0 million) based – as is regularly the case in Q1 and Q3 of a financial year – on an internal valuation. Operating profit (EBIT) totaled EUR 37.3 million (Q1 2021: EUR 47.4 million).

Financial Results

Financing costs fell by 15.2% to EUR -17.0 million (Q1 2021: EUR -20.0 million) and declined at a higher rate than the 8.7% reduction in the financing volume. The largest savings were attributable to conversions of the convertible bond 2024 in connection with the attainment of control by the CPI Property Group. The other financial results of

EUR 45.9 million (Q1 2021: EUR 8,9 million) were based primarily on the positive valuation of interest rate derivatives (EUR 47.5 million) following an increase in long-term interest rates and underscore the Group’s effective hedging policy.

The share of results from equity-accounted investments totaled EUR 17.3 million (Q1 2021: EUR 90.9 million), due to the strong positive revaluation of the S IMMO investment in the first quarter of the previous year. The S IMMO investment was responsible for a proportional earnings share of EUR 15.1 million (Q1 2021: EUR 88.0 million).

Financial results totaled EUR 47.7 million (Q1 2021: EUR 79.7 million).

Net Profit

Profit before tax totaled EUR 85.1 million (Q1 2021: EUR 127.0 million). After the deduction of EUR -12.7 million (Q1 2021: EUR -4.0 million) in income taxes, net profit amounted to EUR 72.4 million (Q1 2021: EUR 123.1 million). That represents earnings per share of EUR 0.55 (Q1 2021: EUR 0.91).

Full Financial Report

The interim financial report by IMMOFINANZ AG for the first quarter of the financial year 2022 is available HERE.

About IMMOFINANZ

IMMOFINANZ is a commercial real estate group whose activities are focused on the office and retail segments of eight core markets in Europe: Austria, Germany, Poland, Czech Republic, Slovakia, Hungary, Romania and the Adriatic region.

The core business covers the management and development of properties, whereby the STOP SHOP (retail), VIVO! (retail) and myhive (office) brands represent strong focal points that stand for quality and service. With the new On Top Living brand, IMMOFINANZ is expanding into sustainable and affordable living.

The real estate portfolio has a value of approximately EUR 5.2 billion and covers more than 220 properties. IMMOFINANZ is listed on the stock exchanges in Vienna (leading ATX index) and Warsaw.