A new survey reveals how affluent millennials earn, spend, and invest their money in the USA.

Millennials have overtaken baby boomers as the largest generation, and as they enter their 30s and 40s, they are shaping new financial trends.

A recent survey by Worth Media Group and Boston Consulting Group (BCG) reveals a multifaceted picture of this influential demographic.

Who are the Millenials?

Millennials, aged 28-43, are moving into midlife with new priorities.

The survey shows that:

- 86% of affluent millennials are married;

- 71% have at least one child;

- 94% own a home.

This indicates family stability afforded by their financial success.

According to the U.S. Census Bureau, homeownership among millennials is generally about 51.5%, but it is significantly higher among the wealthy.

The survey defines wealthy millennials as those with an annual household income of over $250,000 ($350,000 in high-cost cities) or a household net worth of over $1 million. A third of the surveyed group is ultra-wealthy, with a net worth of at least $3 million.

Despite advances towards gender income parity, the survey skews slightly male (61%) and predominantly white (84%).

How They Earn?

Many wealthy millennials start from a position of advantage, with 43% growing up in upper-income households compared to 18% of Gen Xers and 13% of boomers.

Additionally, 28% derive some wealth from inheritance, which is likely to grow as the great generational wealth transfer of over $53 trillion from baby boomers progresses. Notably, 9% benefit from gifted money or possessions, higher than the percentages for Gen X (4%) and boomers (2%). Entrepreneurship is a significant source of wealth for millennials, with 41% citing business ownership, compared to 18% of Gen X and 15% of baby boomers.

While salary is still a primary income source, fewer millennials (81%) rely on it compared to older generations.

How They Invest?

Investment returns are the second most-cited source of income among wealthy millennials (77%).

They are diversifying their investments differently than previous generations. While public markets remain a substantial category, only 31% of millennials invest in them compared to 53% of Gen X and 61% of baby boomers. Instead, they invest more in cash and savings accounts, real estate, private equity, and cryptocurrency.

Millennials prefer to manage their investments independently, with 69% opting to do so without a wealth manager, compared to 53% of Gen X and 36% of baby boomers. Additionally, 28% identify as professional investors.

Social media and digital ads play a role in their investment decisions, though many prefer their own research over professional advice.

How They Spend?

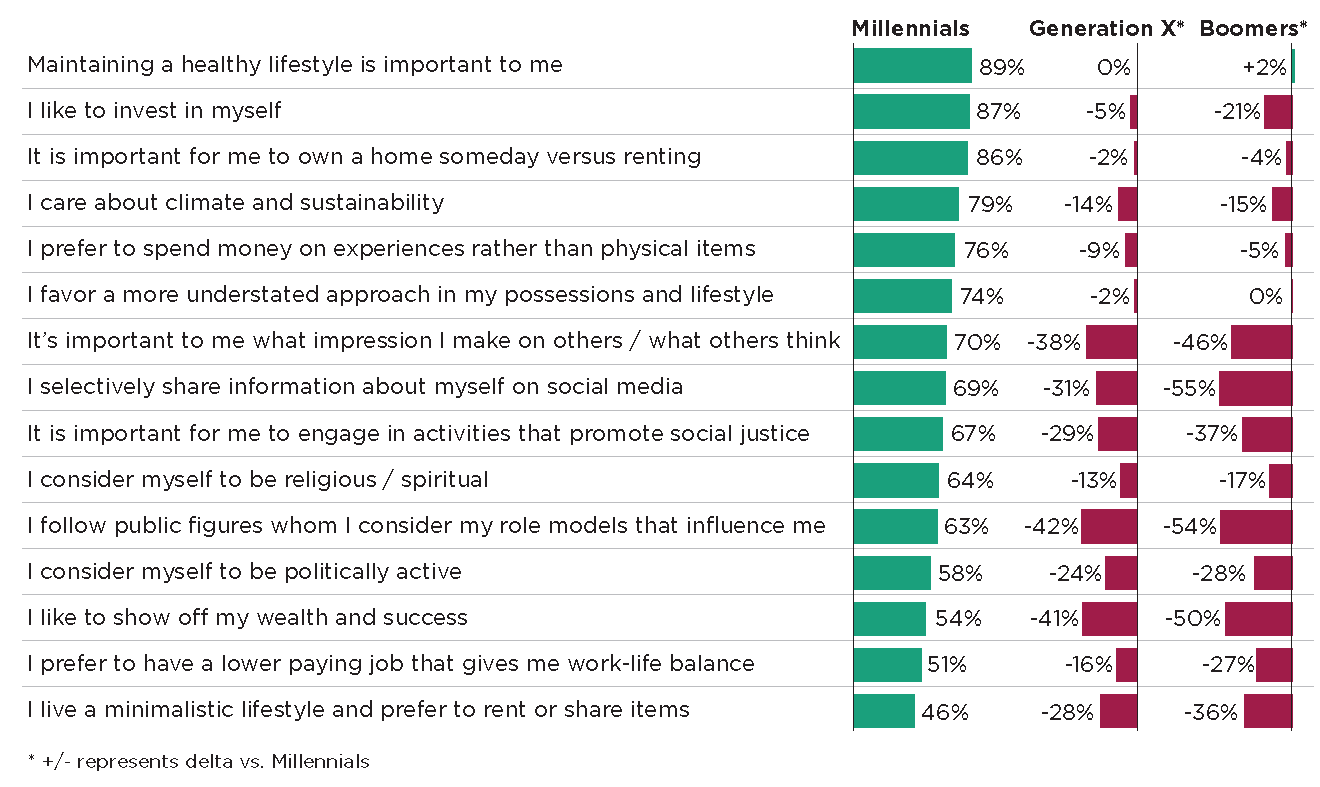

Health and wellness are top spending priorities for wealthy millennials, with 89% emphasizing a healthy lifestyle and 87% investing in personal development.

In the past year, 68% spent money on health and wellness products or services, making it their highest expenditure category.

Luxury items also attract significant spending, with 63% purchasing luxury goods, 55% buying jewelry, and 48% acquiring watches in the past year. Brands like Gucci, Louis Vuitton, Prada, Cartier, and Rolex are particularly popular. Despite this, 74% favor a more understated lifestyle, showing a balance between display and discretion.

When it comes to transportation, millennials are shifting away from car ownership. Only 42% bought a vehicle in the last 12 months, with 36% preferring ride-share apps, car subscriptions, or rentals. They also show less interest in ultra-luxury car brands compared to older generations.

More than half (54%) of millennials purchased experiences (hotels, air travel, etc.) in the past 12 months. However, Gen Xers and baby boomers are 20% to 25% more likely to have recently made a purchase in this category—possibly due to having more time.

Philanthropic spending is less of a priority, with only 24% donating money to charitable organizations. However, 44% prefer to donate their time and skills, indicating a hands-on approach to philanthropy.

What They Care About?

Wealthy millennials prioritize sustainability and social justice.

According to the survey, 79% care about climate and sustainability, surpassing the concerns of Gen X by 14% and boomers by 15%. Additionally, 67% value activities that promote social justice, which is significantly higher than older generations.

While traditional philanthropy is not a major focus, many millennials are exploring impact investing and sustainable business practices.

They aim to align their financial activities with their values, seeking both financial and social returns.

Understanding Millennial Financial Behavior

Wealthy millennials are forging new financial paths as they enter their peak earning and spending years.

Their entrepreneurial spirit, preference for independent investment management, and focus on health, wellness, and sustainability are reshaping markets. For businesses aiming to engage with this influential demographic, understanding these behaviors is crucial.

The insights from the Worth Media Group and BCG survey provide valuable guidance for tapping into the unique preferences and priorities of affluent millennials.

For more detailed findings, the executive summary of Worth’s Millennial Mindset Report is available at worth.com/millennial.